The requested article has expired, and is no longer available. Any related articles, and user comments are shown below.

© Copyright 2021 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed without permission.

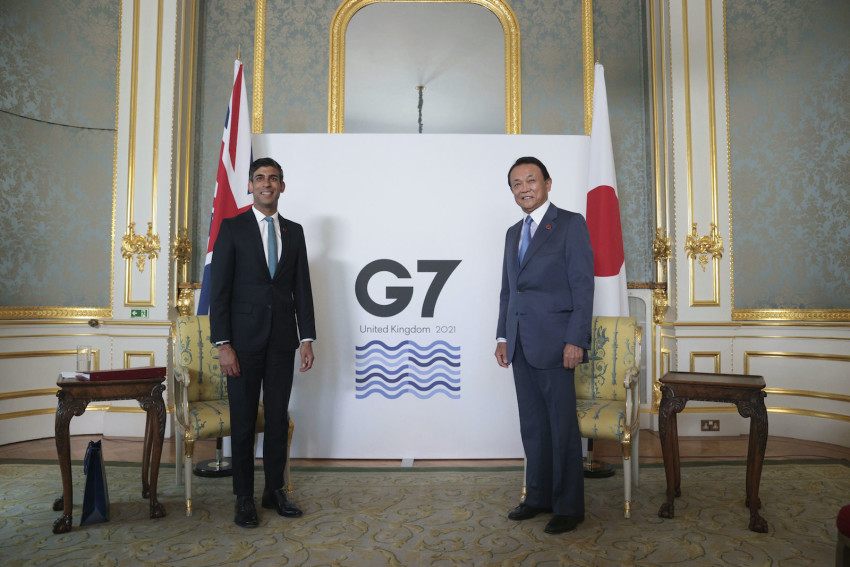

Global corporate tax proposal in focus at G7 finance ministers' meeting

By DAVID McHUGH FRANKFURT, Germany©2024 GPlusMedia Inc.

Take our user survey and make your voice heard.

Take our user survey and make your voice heard.

21 Comments

Login to comment

Cricky

Bet they get lowered to 15%, while workers taxes go up. As far as post pandemic recovery Japan can lead the way on this, give the workers nothing but funnel money to companies with Huge savings. Also the system of part-time murky multilayered employment is a must have. Think Japan might actually be a leader for a robust plan for economic growth worked for the last 30 years. I like cup noodles by the way, very romantic with a candle.

snowymountainhell

After such a long flight to London, Mr. Aso looks remarkably ‘well-rested’. - ‘Let’s all hope he can focus, perhaps ‘close his eyes’ and ‘listen attentively’ to his hosts and the other distinguished guests. -

dagon

Biden's push for a global minimum corporate tax of at least 15% has unblocked stalled global tax negotiations and raised prospects of an agreement this year, although key aspects such as the actual rate remain to be decided.

Go back to the good ole days of 75%-90% taxes on the highest earning as in the Kennedy/Eisenhower years. Coincidentally, it was a time of growth, innovation and strong middle class wealth.

Everyone acknowledges the ultra wealthy pay a shockingly little amount of tax, Amazon stands out and Trump brags about it in debates.

There has been 40 years of the tax burden being regressively shifted onto the backs of workers. Time for a reappraisal.

Alfie Noakes

As if by magic:

An Irish subsidiary of Microsoft made a profit of $315bn (£222bn) last year but paid no corporation tax as it is “resident” for tax purposes in Bermuda.

The profit generated by Microsoft Round Island One is equal to nearly three-quarters of Ireland’s gross domestic product – even though the company has no employees."

https://www.theguardian.com/world/2021/jun/03/microsoft-irish-subsidiary-paid-zero-corporate-tax-on-220bn-profit-last-year

The guy on the right is married to Akshata Murty, daughter of the billionaire co-founder of Infosys and one of the richest people in India. Her family has a a £900m-a-year joint venture with Amazon in India, through an investment vehicle owned by her father. Akshata Murty is richer than the Queen. The guy on the left we all know.

https://www.theguardian.com/politics/2020/nov/27/huge-wealth-of-sunaks-family-not-declared-in-ministerial-register

Hands up all those who think such people as Sunak, Aso and Biden are going to reform the global corporate tax system.

thepersoniamnow

I guess they got the jabs already? No mask??? lol

dagon

Hands up all those who think such people as Sunak, Aso and Biden are going to reform the global corporate tax system.

The foxes guarding the henhouse. Plutocracy in action.

M3M3M3

This is a red herring being pushed by the US and people in the pocket of tech giants. As part of this agreement, America will be demanding that the G7 & EU abandon or scale back any plans to impose larger and more significant taxes on digital services sold by US tech companies. They were threatening Austria, Italy and Spain this week with massive retaliatory tariffs for trying to collect a small sales tax on digital ad sales, so they're clearly not concerned with shoring up public finances or seeing companies pay their fair share.

Imposing a sales tax directly on Netflix subscriptions, Uber rides and Facebook ads sold in EU or Japan is a far cheaper and simpler way of collecting this money than hiring tax inspectors and forensic accountants to chase down shell companies in the Cayman Islands.

Ai Wonder

Ridiculous that super rich corporations can get away with paying way less in tax than ordinary workers. In some cases they pay nothing. A subsidiary of Microsoft paid zip tax on over 300,000,O00,000 dollars of profit and their HQ is in Ireland. These vastly rich corporations are like parasites. Time for change. Time for them to pay their fair share on their massive profits, and Biden’s proposals are a great step in that direction in their original form and they should not be watered down.

Yotomaya

A British Tory and a Japanese LDP member meet to discuss inequality and holding corporations accountable. Yeah, right.

proxy

The US larder is bare and taxes will need to be increased for everyone. The easy target is to go after "evil" corporations and Biden can only do this by forcing other countries to do what the US tells them to do because everyone knows US corporations will flee the country when they get the Biden tax bill.

If Ireland wants to have a corporate tax rate on 12.5% and raise taxes through a 23% VAT tax that is their business and they should tell Biden to go pound sand.

Goodlucktoyou

How do you tax, tax havens? I’m perplexed.

fxgai

The OECD found that corporate tax is the most harmful tax for economic growth.

Corporations are people - workers, consumers, tax payers.

People pay corporate tax, not Santa Claus or the tooth fairy.

This arrangement with no mandate is the type of thing that makes me want to revolt...

Individual freedom and liberty! Free markets! Not collusion between big governments!

dagon

The plutocrats have done a good job in obscuring the nature of progressive taxation, making Joe Public and Taro Nakamura believe a sliding scale progressive tax rate will burden their small business. While Warren Buffet acknowledges his secretary pays a higher percentage of tax than he does.

Along with fluff about freedom, liberty and corporations being people. But people are getting wise to these rhetorical strategies.

fxgai

Useful idiots so happy to jump into bed with central government politicians... to the detriment of all, but it’s the most vulnerable who always suffer the most from policy mistakes.

AramaTaihenNoYouDidnt

The true makers of greed in play by design.

And...GOJ, will you PLEASE lay off giving Aso two titles when clearly is unable to exercise one role adequately. He's your number one public debt contributor.

dagon

So many content to lick the boots of transnational capital and their political lackeys. No matter how much they support the policies of the people in the picture above and the corporate oligarchs they represent, they will never be elevated to their class. Leona Helmsley, one of Trump's compatriots in NYC real estate summed it up: ""We don't pay taxes. Only the little people pay taxes."

Desert Tortoise

I want to see corporations pay a specific tax to support the vast militaries necessary to protect their global commerce. Corporations should be responsible for at least half and preferably more of their nation's military budget. If the US has to deploy the 7th Fleet to the western Pacific and South China Sea to protect western maritime commerce, make those same companies who benefit from that protection pay the price. Every shipper with a container on a ship benefits from western navies and air forces protecting their navigational rights but their tax remittances are a pittance in comparison the the budgets of their militaries.

Desert Tortoise

Btw, Chinese companies shipping their products around the world on ships flagged in places like Panama or Marshall Islands benefit from the protections to shipping offered by western navies who guard those shipping lanes and make those Freedom of Navigation Ops in the SCS, so their earnings in western nations should also be taxed to support the various western armed forces protecting their commerce.