On Oct 1, the consumption tax in Japan rose from 8 percent to 10 percent. While paying extra for stuff is never nice, we have to admit we're really enjoying the sudden decrease in one-yen coins in my pocket as a result of the newly well-rounded percentage.

Many others aren’t quite as half-glass-full, however, which is probably why the government tried to soften the blow of this tax hike by making certain exemptions. For example, necessities like food bought from supermarkets will retain their 8 percent tax, but “luxuries” like alcohol remain at 10 percent.

However, one strange exemption is that take-out food from restaurants will have a “reduced” (i.e. unchanged) tax at 8 percent, while eat-in orders will be taxed at 10 percent. Restaurants have found various ways to cope with this, such as by adjusting their prices to be equal regardless of the eat-in or take-out tax.

This raises a number of problems for other businesses too though. For example, many convenience stores in Japan have a small counter where customers can sit and eat the bento or coffee they just bought, but should that make them equal to a full-fledged restaurant and held to the same tax standards?

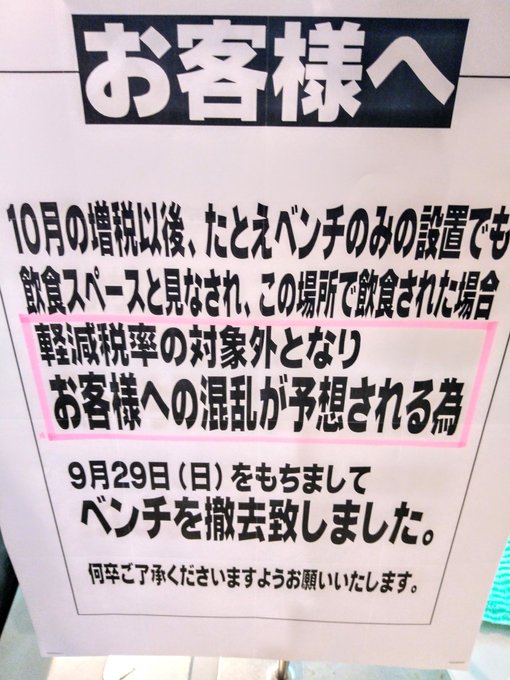

Or in this instance, discovered by Twitter user Kaname Miyagi (@KanameMiyagi), a supermarket with a bench in front felt forced to make a difficult decision and came to the following conclusion: “For a sales tax reduction, the bench is gone from this supermarket.”

The sign in the store explains that because of the sales tax increase, the bench that once sat in that location could be regarded as an “eat-in” space. This means that any customer who eats on the bench would be technically duty-bound to pay the full 10-percent tax.

This creates a lot of problems, such as the fact that customers probably would have already paid for their food with an eight-percent tax before choosing to use the bench and perhaps snacking on something they got. At that moment, the store feels it is either responsible for paying the remaining balance themselves, or the store would have to go and demand the two percent from the customer.

Envisioning the confusion this would cause, the supermarket decided to just get rid of the bench altogether. While this eliminates the aforementioned problems, not having a bench at all certainly isn’t an ideal solution, and many netizens expressed their outrage at the store for it.

“Just get rid of the much needed bench, to avoid a slightly awkward situation. Problem solved!”

“The supermarket is willing to make customers suffer in order to save a little money.”

“All they have to do is put a NO EATING sticker on it. Are they dumb?”

“When I’m shopping with my parents these benches are very important. They need to take a rest.”

“They aren’t even considering the customers, they’re just thinking about themselves.”

While many felt the supermarket was acting callously, others directed their anger at the government for creating these seemingly arbitrary conditions.

“All because of these stupid rules for the tax increase. These idiots who make the laws need to go to a supermarket once in their lives and see how they work.”

“Either the government is really stupid or really doesn’t care.”

“What a terrible world. These things are important for the sick and elderly.”

“Great, taxes are literally killing people now.”

Perhaps both the supermarket and government should take a piece of the blame for the inconvenience caused by the lack of bench for those who truly need it. However, just putting a “NO EATING” sticker on the bench really does seem like it would have been an easy fix.

It’s hard to judge them too harshly though, as tax hikes are emotionally difficult times for everyone and we all deal with them in different ways.

Sources: Twitter/@KanameMiyagi, Hachima Kiko, Hamusoku

Read more stories from SoraNews24.

-- Japanese convenience stores want you to be honest and request to pay higher sales tax rate

-- Nara’s “deer cookie” rice crackers get their first price increase in 28 years

- External Link

- https://soranews24.com/2019/10/05/supermarket-throws-away-bench-because-of-sales-tax-hike-angers-many/

Take our user survey and make your voice heard.

Take our user survey and make your voice heard.

30 Comments

Login to comment

kurisupisu

Tax on food?

Japan’s politicians are so far removed from the lives of ordinary folk...

sakurasuki

Those comments are real, saw some elders need to have some rest before they can go home after doing their shopping.

Seat or no seat, 2% decision.

Speed

Great. Not as if there's hardly any places to sit already.

Serrano

Move to Canada. We don't tax food. Any country that does, is sick.

Jeez, there be a lot of sick countries!

sakurasuki

Enjoy while you can, it's only until next year. After that you need to pay full with tax.

Dio

japa government is full old farts that have no idea about a normal life.

it’s time to change that

Bugle Boy of Company B

If the tax was 10% for everything the store would not need to remove the bench.

fxgai

Um, how does having a label/ sticker / sign actually solve the issue?

Those in the article who blame the government for creating the environment that distorts behavior are correct, the authorities are solely responsible for this.

kurisupisu

@Marcelito

Yes, I was and IMO it is a most punitive tax on the poor.

kohakuebisu

Supermarkets are much cheaper than convenience stores, so they are a good place to eat. I sometimes go when I'm out on my bike.

Removing the benches strikes me as an OTT, blame-shifting solution. A sign at the tills saying "please declare any eat-in items" would have sufficed.

Norman Goodman

You would think a giant like 7-11 could bring these tax loving politicians to heel and fix the law so that if its put in a take out bag is automatically take out even if they eat in the store....and of course that would not work for a proper restaurant....any place with actual cooks, waiters and waitresses.

Yubaru

I went food shopping the other day with my wife and we checked out the receipt, the ONLY thing that was charged at the 10% rate was my beer! Everything else was 8%, even the junk food!

Food is NOT being taxed! Eating it on the premises is! Large difference!

fxgai

Costs can be made effectively zero for the needy by redistributing tax revenues to the needy.

Giving the rich etc tax breaks in the name of helping the poor... no, just give the needy the assistance they need. And remember a no income person needs assistance whether tax is 0 or 100

TrevorPeace

@Yubaru, you're wrong to say food isn't taxed. It may not be taxed the extra 2%, but it's already taxed the 8%. And that, frankly, is disgusting. Move to Canada. We don't tax food. Any country that does, is sick.

Joe Blow

That's how taxes work.

The ultra-rich pay nothing in taxes. It's the middle class and poor who do.

Cogito Ergo Sum

It's said an octopus turns itself in a hot frying pan. To keep up its status the Japanese are frying themselves. With the world economy slowing down, was this the only way ?

WA4TKG

I love this comment:

“Great, taxes are literally killing people now.”

Sounds like something I would say.

Do the hustle

I’m leaving Japan this year. I’ll let it to you to enjoy being over taxed.

cleo

You just stated that food is being taxed at 8%. How is that 'not taxed'?

You mean you want the poor to live on charity, with a big 'We are officially poor' label stuck on their backs? Maybe we should reinstate to Poor Houses for them?

No one is saying that.

jpg_guy explains it clearly and succinctly.

Invalid CSRF

fxgai

That's not what I was saying either really, what I am saying is that looking at consumption tax in isolation, without considering redistribution to the poor from the government as well - e.g. the big picture - is essentially meaningless, from the perspective of the welfare of poor people.

This is because a person who has zero income (and zero savings) cannot buy /anything/, irrespective of the consumption tax rate or whether food and other "essentials" (however defined) is included.

If the government had a consumption tax, and NO spending programs to look after the poor, then yes that would be totally messed up. But that's not the case.

The reason why governments turn to consumption tax is because it's a stable source of tax revenues, unlike sources of tax that are correlated with economic conditions. If the whole economy goes into recession and tax revenues were correlated with how much money people and companies make, tax revenues would plummet in harsh times.

It is harsh times when the people need support the most - and that would be the same time as tax revenues plummet!

On the other hand, consumption tax revenues collected at a low, flat rate across the board, have been shown to be much more uncorrelated with economic conditions. Yes - your points about it being a regressive tax on the poorest is true, but my point is that the government assistance for the poor has to be considered as well - the whole picture needs to be seen.

Again, taxation is only one part of the equation. The poor are the ones who (ought) receive the benefits of government spending through welfare programs, etc. The taxation side of the equation is more about efficiently collecting tax revenues with minimum impact on the economy, /so that/ the government can ensure that the poor people who need help, can be supported with those tax revenues.

Yes, the government is making a hash of the redistribution, no doubt - they should be spending the money much better - but that spending is the problem, not the fundamentally good idea of a broad-based, low rate consumption tax as a stable source of tax revenues.

I can point to counter examples. I believe that Singapore has a flat rate of sales tax (they aren't too dumb when it comes to economic management) and New Zealand has a flat rate at 15% (as well as a social welfare system to look after the poor).

I think the politicians in countries such as those you point at (and now Japan) have simply made poor economic decisions for the purpose of political expediency - I question very much that it's worse to be a poor person in a country with various sales tax rates, than countries that have simple tax systems together with welfare safety nets to look out for the poor.

And one thing that has been shown time and again is that multiple rates of sales tax does cause ridiculous debate about exactly how to place the exemption boundaries, Japan is just the latest example!

I believe it was the Soka Gakkai-backed Komeito party which demanded this multi-rate consumption tax, and the LDP went along with it because they are in coalition.

fxgai

While having a zero tax rate on food might make some people feel good about themselves, it's actually no plan to ensure that no-savings, no-income poor can actually have food and shelter. Having zero tax on food simply cannot ensure that all people can have food, and so that's a BIG fail.

I want to see the poor have food and shelter, personally. You should too. A holistic system for that purpose should be the goal, not well-meaning-but-off-mark gimmicks.

From an environmental perspective, the government should not be enacting policies that do anything to economically incentivize people to use more bags.

cleo

That's a good reason for food to be zero tax.

I don't see anyone making that argument. Strawman.

Again, no one is saying that. Another strawman.

'A does not lead immediately and directly to B' does not mean that A needs to be scrapped; it simply means that B is complicated and requires other measures in addition to A.

(For example: Simply buying a length of worsted does not mean I can make a suit of clothes; I also need lining material, cotton thread, buttons, a sewing machine, pins, needles, textile chalk, a pattern, and the dexterity/know-how to make the transformation. You're saying simply buying the worsted is not enough to make the suit (and strictly speaking, you're right): so we should forget the worsted altogether try and make the suit just using buttons, pins and thread.)

And I do. Which is why I would like to see those with most wherewithal contribute more★, without stigmatising those who need help.

★As a percentage of income, of course, it isn't more at all.

fxgai

Are whales food?

And even if you accept that, why stop at food?

But you just did.

You lost me on the next bit but finally:

A rich person living the high life off their wealth will certainly spend more and thus pay more in consumption tax than the poor. Perhaps you want to say that this is /still/ not enough - so, a wealth tax?

I don’t see how wanting to give the needy assistance via government spending is to stigmatize them. At least that’s not what it is in my mind.

cleo

Not in my house, they're not. What's your point?

The problem with whales and tax is that the so-called commercial whale killers want the government to subsidise them out of my tax money (and the tax money of low-income folk who are paying through the nose for the basics and will never be able to afford ¥15,000 a kilo for whalemeat, even if they wanted to eat it, which most Japanese don't.) so that rich old men with nostalgia for the old days can indulge.

I wouldn't stop at food. Medicine and education should also be tax-free. You know, the basic essentials of life.

No. I'm not saying food should be zero tax because it 'makes me feel good' (I would probably lose out because my income tax have to would go up to make up the shortfall, and/or consumption tax on non-essential items would go up), but because it's immoral and regressive to tax people on things they must buy.

In absolute terms, maybe. But not as a proportion of their income.

A person with an income of say, ¥150,000 a month and spending a frugal ¥30,000 on food is eating a fifth of their income. At 8% consumption tax, that's ¥2,400, or 0.016% of his income.

A person with an income of ten times that, ¥1,500,000 a month and living it up on restaurant meals might spend what? Let's not make him a total glutton, say a little over three times what our poor man eats, ¥100,000 a month on food. A fifteenth of his income. And because he's living the high life, it's all in restaurants, at 10%: ¥10,000 consumption tax. Yes, over four times what the poor man pays, in absolute terms. But in terms of a percentage of his income? A mere 0.0067%. About a quarter what the poor man pays. He doesn't even notice it.

fxgai

Yes. Having a simple single rate of tax for everything is easy.

And think about it. If your rich people go out and pay 20,000 for a fancy dinner, they would pay 2,000 yen in consumption tax.

That 2,000 yen can be used to buy four meals for the needy.

... if, that is, the government had a clue...

fxgai

Yes, it is tough on the poor.

So have the government give them some money!! That's one of the top reasons why we should pay taxes to the government, right? To help the needy!

The main purpose of taxes is to efficiently raise revenues so that the government has funds that it can redistribute, in such a way as it sees fit. The purpose is not to punish the poor - if the government is doing a good job of redistributing the tax revenues collected, the poor should actually come out ahead.

But we can't just say "let's have no taxes because it hurts the poor". Taxes are only a part of the equation. A poor person (might be someone with disabilities etc, through no fault of their own) who has absolutely zero income, needs support. Taxing them zero on their food doesn't help them. They need assistance from the government, and an efficient, simple tax system is the best way in which to obtain revenues to help them.

Unfortunately, there is definitely an argument to be made that Japan's government is spending its revenues in crazy ways. And having a more complicated tax system is also a fail.

Disillusioned

If you use electronic payment you do not pay the extra tax. I pretty much live off my SUICA card these days.