Fujitsu and Hokuhoku Financial Group, Inc have announced the development of an algorithm to support information disclosure in line with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD).

The two companies conducted trial demonstrations and confirmed the efficiency of the new algorithm in supporting customers in improving their operational efficiency when preparing for TCFD reporting.

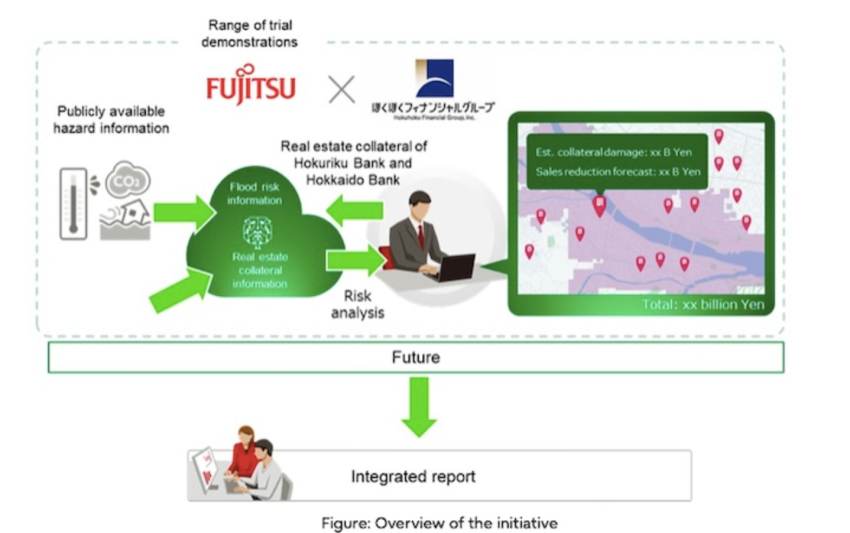

The new algorithm developed by Fujitsu automatically arranges customer data and hazard data issued by the government on a map to calculate the physical risk of a customer or asset in the event of a flood.

Climate change poses a major, ongoing economic threat, and not only listed companies but also many affiliated companies are increasing their efforts to resolve the myriad issues related to global warming. Underlining the growing significance of this responsibility, players in various industries increasingly focus on TCFD as a measure to disclose climate-related financial information.

In Japan, since April, companies listed on the Tokyo Stock Exchange's Prime Market are required to disclose TCFD information, and the impact of climate-related risks on companies and their measures to mitigate its impacts have been attracting growing attention. Companies situated in flood-prone areas are especially vulnerable, as they are continuously exposed to significant risks that can affect the continuity of their business.

The implementation of cross-industry measures that also include players such as logistics companies that transport goods and institutions that finance climate change initiatives represent an ongoing task.

To address this issue, Fujitsu and Hokuhoku FG developed new measures to accurately and efficiently measure flood risks, which represent a high-priority issue within climate-related risks.

Outline of the trial demonstrations

Fujitsu and Hokuhoku FG conducted trial demonstrations of the newly developed algorithm from November 2021 to March 2022 for real estate collateral of the Hokuriku Bank and the Hokkaido Bank. Leveraging Fujitsu's IT technology and Hokuhoku FG's knowledge of risk management practices, the two companies systematized a process to plot customers' properties on a hazard map and predict potential flood risks. As a result, Hokuhoku FG employees were able to streamline approximately 850 hours of manual work time and to improve efficiency in their preparation for TCFD reporting. The two companies further confirmed the effectiveness of the newly developed algorithm in correctly measuring flood risks.

© JCN Newswire Take our user survey and make your voice heard.

Take our user survey and make your voice heard.

2 Comments

Login to comment

Azzprin

.

So if your home is one meter lower than your neighbour, then you could pay more for flood insurance than them.

.

Best way to reduce your risk of flooding by not building on flood risk areas lthat were/are natural flood planes.

.

As cities, towns and villages expand they reduce the area that rain water can be absorbed naturally into the ground and that water ends up flowing down to the nearest low area which becomes overwhelmed as the ground can not absorb it fast enough.

.

Flood defences in one area can push their problem onto another area that previously not flooded.

Yrral

Pie in the sky